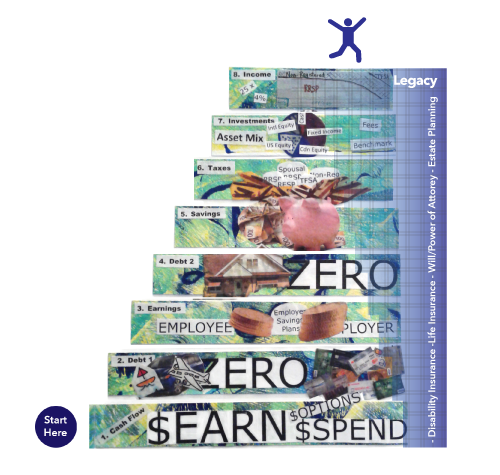

Steps to Financial Success

A picture is worth a thousand words, and some prefer pictures over words. But, in case you’d like the words to help you understand our “Steps to Financial Success” picture, here you are!

The steps are definitely in order of priority. It is hard to move to a higher step without first mastering, or at least having a handle on, the previous steps. The steps are also somewhat in age order. Typically at younger ages, you’re worrying about the first few steps. As you near retirement, you’re needing to address the higher steps.

Here’s a brief summary of what each step is trying to tell you:

Step 1 — Cash Flow

Your first priority has to be to make sure that you’re “cash flow positive” – that the money you spend is less than the money you earn. That gives you choices for the “extra” money. If you spend more than you earn, you will do nothing more than spiral down into more and more debt (the polar opposite of financial success).

Step 2 — Zero Debt #1

Debt is your enemy, especially debt that is incurring big interest charges, like credit card debt. Some debt is necessary and will create value – such as a student loan or a loan on a vehicle that gets you to work or helps you earn a living. However, in general, you want to avoid any debt on items that depreciate in value. Pay off your debt and avoid incurring more. Anyone who tells you that something costs “only $XXX a month” is talking you into incurring more debt. Take the time, do the math (or get a friend to help you) and figure out how much you’re Really paying for that item!

Step 3 — Employer Savings Plans

Once you’ve nailed your debt, you should have money to take advantage of anything your employer offers you. If they offer to match your contributions to an RRSP or savings plan, get the free money, and start your serious savings program at the same time. The beauty of employer savings plans is that, once you get used to the reduced pay check, you will never miss the money. Try it out. If it’s really too scary, put your next pay raise into the savings plan.

Step 4 — Zero Debt #2

No, we didn’t think you’d forgotten the “Zero Debt” rule. Some debt is either necessary or helpful, like a mortgage on your home. It’s pretty tough to buy a home and avoid any sort of mortgage. (If you can do that, you’re probably past this step anyway!) Also, buying an asset that can be expected to appreciate in value is a good use of your money. We still recommend paying it off though. Paying off any debt gives you automatic savings of all the interest you would have otherwise paid.

Step 5 — Savings

Finally, you’re getting to save some money … when you’ve taken care of all your debt. Arguably, you could be saving while you’re still paying off debt, but the return on paying off debt generally makes debt reduction a better investment. Do the math on your situation. The objective is to increase your Net worth over time (i.e., savings and assets minus debt).

Step 6 — Taxes

Now that you’re saving something, you will want to figure out the most effective way to save it. That’s why you now need to learn about tax sheltered savings vehicles, like RRSPs, TFSAs, RESPs and RDSPs, and direct your savings appropriately (depending on your objectives for your savings).

Step 7 — Investments

When you start saving and you have a small amount of assets, you’re limited in your choices of investments. The investment choices offered by your employer or financial institution are very good places to start. As your wealth increases, however, you will be able to and will want to pay more attention to how your savings are invested. Good investment choices can increase your savings dramatically.

Step 8 — Income

You’ve saved a nice nest egg … but is it enough to generate a steady income in retirement? The withdrawal of an income from your savings is another whole area of finance by which you can be challenged!

Plus — Legacy

Legacy is only a worry at the end of your life. However, life is fragile and none of us have any guarantees. You always need a will because it is really messy if you die without one, and of particular concern if you have any sort of debt, sizeable assets, young children, or other dependents. Especially when you are younger, you need to pay attention to insurance needs. What would happen if you were disabled? How would your dependents manage if you died early? As you get older and grow your net worth, legacy issues take up more of your attention and estate planning will be important.

The purpose of our staircase is to help you focus. You need not be paralyzed by all the choices and financial jargon out there. Master the steps one at a time and you’ll be surprised at how financially astute you are by the time you’re dancing at the top!

At RetirementWorks, our mission is to provide independent, unbiased and factual information solely for educational purposes.