On the Retirement Stage: The Millennial Generation

Part I — The Challenges

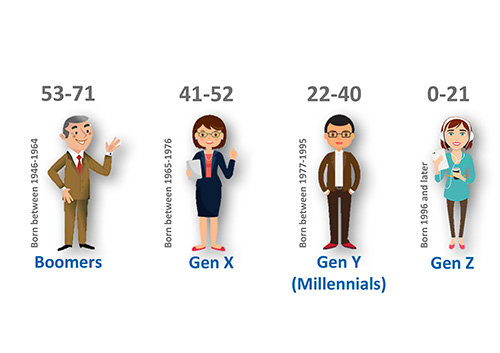

Millennials, also known as Generation Y, are soon going to be the biggest influencers of today’s workforce. Although saving for retirement may not yet be on top of their to-do list, it will not be long before they have to tackle the issue. To gain a better understanding of Millennials’ financial priorities, and why retirement saving may not be one of them, we can start by looking at the challenges they face that may be different from previous generations.

1 — Education Costs Money

Millennials have been recognized as the most educated generation. This comes at a price. They are the generation with the most amount of debt, mostly student loans. If one has to live paycheck to paycheck, it becomes increasingly harder to pay off one’s student loans.

2 — Wealth Gap

There is an increasing wealth gap between Millennials and their Boomer parents. A typical Millennial today earns 9% less today for full time work than three decades earlier, and given the rise in housing costs, he must cover mortgage payments that are 9% higher compared to three decades ago1. The effect is that Millennials, despite being the most educated generation, start with lower household income and struggle to meet basic expenses.

3 — Volatile Financial Markets

Millennials have seen the financial crisis of 2008 and the subsequent volatile financial markets. This has left them wary of investing in stocks and with a lack of trust in financial markets. They are also concerned with the state of the world and feel obliged to change it through their actions.

4 — Workforce Reality

The reality is that today’s young generation is driven by money and promotion rather than loyalty to their employer. They value work-life balance and unlike their Boomer parents do not live to work, nor will they wait for those golden retirement years to enjoy the fruit of their hard-earned labour. The retirement experience is to be lived now! As a result, we have a highly mobile workforce interested in what the present offers.

5 — Boomer Parents

Boomer parents are known for their micromanagement and helicopter parenting. As a result, their Millennial children lack confidence and knowledge in financial matters. The good news is that Millennials are hungry for financial education, but beware that traditional preaching will not work with this generation.

For a generation who struggles with debt, the next focal point is naturally debt management. Here, we want to point out the difference between good debt and bad debt. Good debt is the kind of debt that is necessary and sustainable, and it creates value in future. Bad debt is the kind of debt that is unnecessary and unsustainable; it drains wealth without the prospect of ever paying for itself. A student loan is a good debt; credit card debt a bad one! Not incurring bad debt in the first place, or paying it off as quickly as possible should take priority over paying off good debt.

What will help spur Millennials to take more of an interest in retirement planning are new and innovative ways to deliver the financial education they so sorely crave.

Stay tuned for Part 2, where we’ll explore some of the ways Millennials can be more engaged in their financial planning. Once they can tackle their financial problems of today, they will then be empowered to take on larger challenges they’ll face, such as retirement.

1 Population Aging, Generation Equity & the Middle Class, Dr. Paul Kershaw

At RetirementWorks, our mission is to provide independent, unbiased and factual information solely for educational purposes.